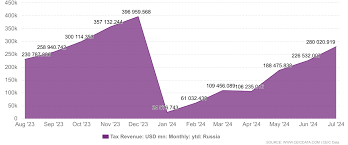

Russia’s tax system is a complex web of federal, regional, and local taxes. While it has undergone significant reforms in recent years, it still presents challenges for both individuals and businesses.

Key Taxes in Russia

- Value-Added Tax (VAT): A broad-based consumption tax levied on the sale of most goods and services.

- Income Tax: A progressive tax on personal income, with different rates for individuals and legal entities.

- Property Tax: A tax on real estate, including land, buildings, and other structures.

- Excise Tax: A tax on specific goods, such as alcohol, tobacco, and fuel.

- Corporate Income Tax: A tax levied on the profits of corporations and other legal entities.

Challenges in the Russian Tax System

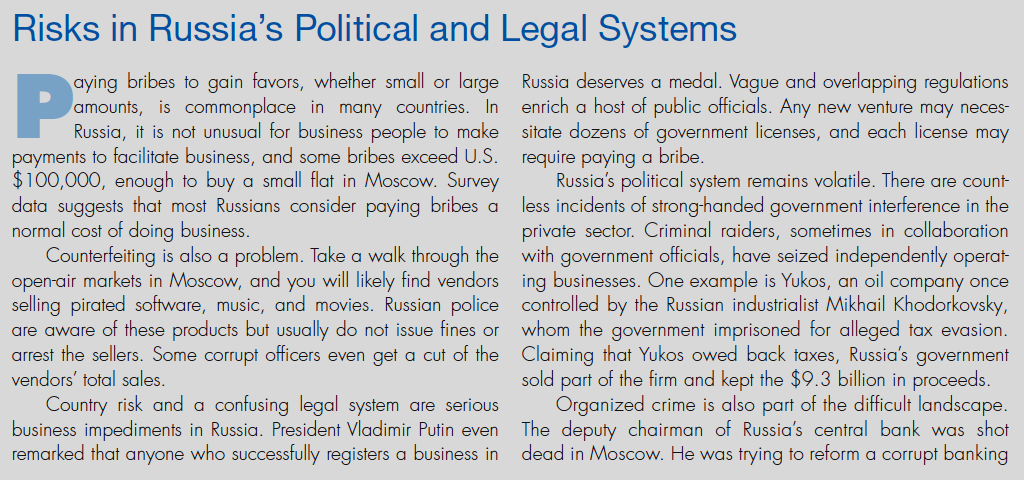

- Complexity: The Russian tax code is complex and subject to frequent changes, making it difficult for businesses and individuals to comply.

- Corruption: Corruption can lead to tax evasion and unfair competition.

- Administrative Burdens: Bureaucratic hurdles and excessive paperwork can hinder business operations and increase compliance costs.

- Tax Evasion: Tax evasion remains a significant problem in Russia, reducing government revenue and distorting the economy.

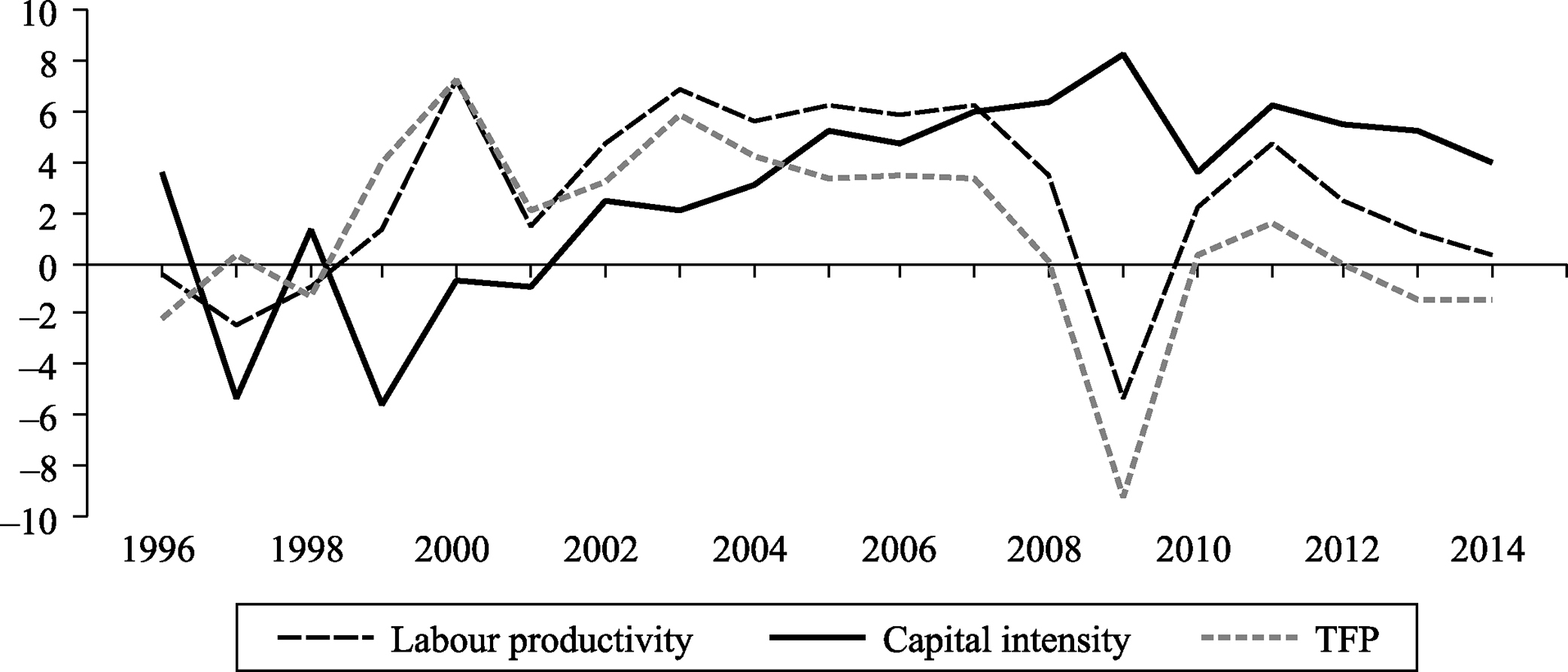

Recent Reforms

The Russian government has implemented various reforms to modernize the tax system and improve tax administration. These reforms include:

- Simplification of the Tax Code: Efforts to streamline the tax code and reduce the administrative burden on taxpayers.

- Digitalization of Tax Administration: The use of digital technologies to improve tax collection and compliance.

- Strengthening Tax Enforcement: Increased efforts to combat tax evasion and corruption.

- International Tax Cooperation: Cooperation with other countries to prevent tax avoidance and evasion.

While these reforms have made progress, further efforts are needed to create a more efficient and transparent tax system. By addressing the challenges and implementing additional reforms, Russia can improve its tax collection and create a more favorable business environment.

Leave a Reply