Russia’s investment landscape is a complex interplay of opportunities and challenges. While the country offers significant potential for foreign investors, geopolitical tensions, economic volatility, and bureaucratic hurdles can pose significant risks.

Key Investment Sectors

- Energy: Russia’s vast reserves of oil and natural gas make it a major player in the global energy market. Investments in the energy sector, including exploration, production, and infrastructure development, can be highly profitable.

- Mining and Metals: Russia possesses abundant mineral resources, such as iron ore, nickel, and aluminum. Investing in mining and metals can provide exposure to global commodity markets.

- Agriculture: Russia’s fertile land and favorable climate conditions offer opportunities for investment in agriculture, including crop production, livestock farming, and food processing.

- Manufacturing: The Russian government has been actively promoting the development of the manufacturing sector, particularly in industries such as automotive, aerospace, and pharmaceuticals.

- Technology: Russia has a strong tradition in science and technology, and there are opportunities for investment in IT, biotechnology, and other innovative sectors.

Challenges and Risks

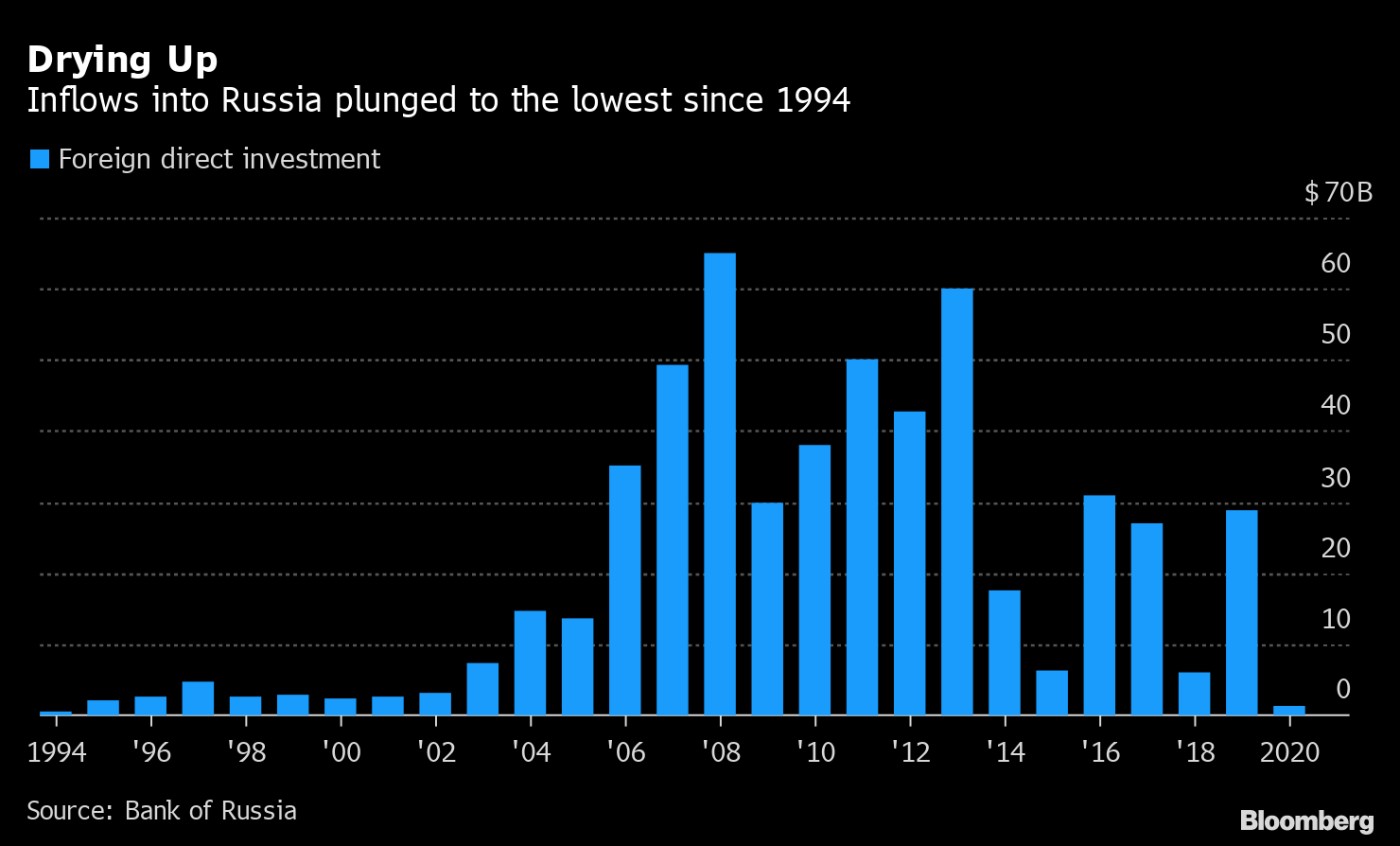

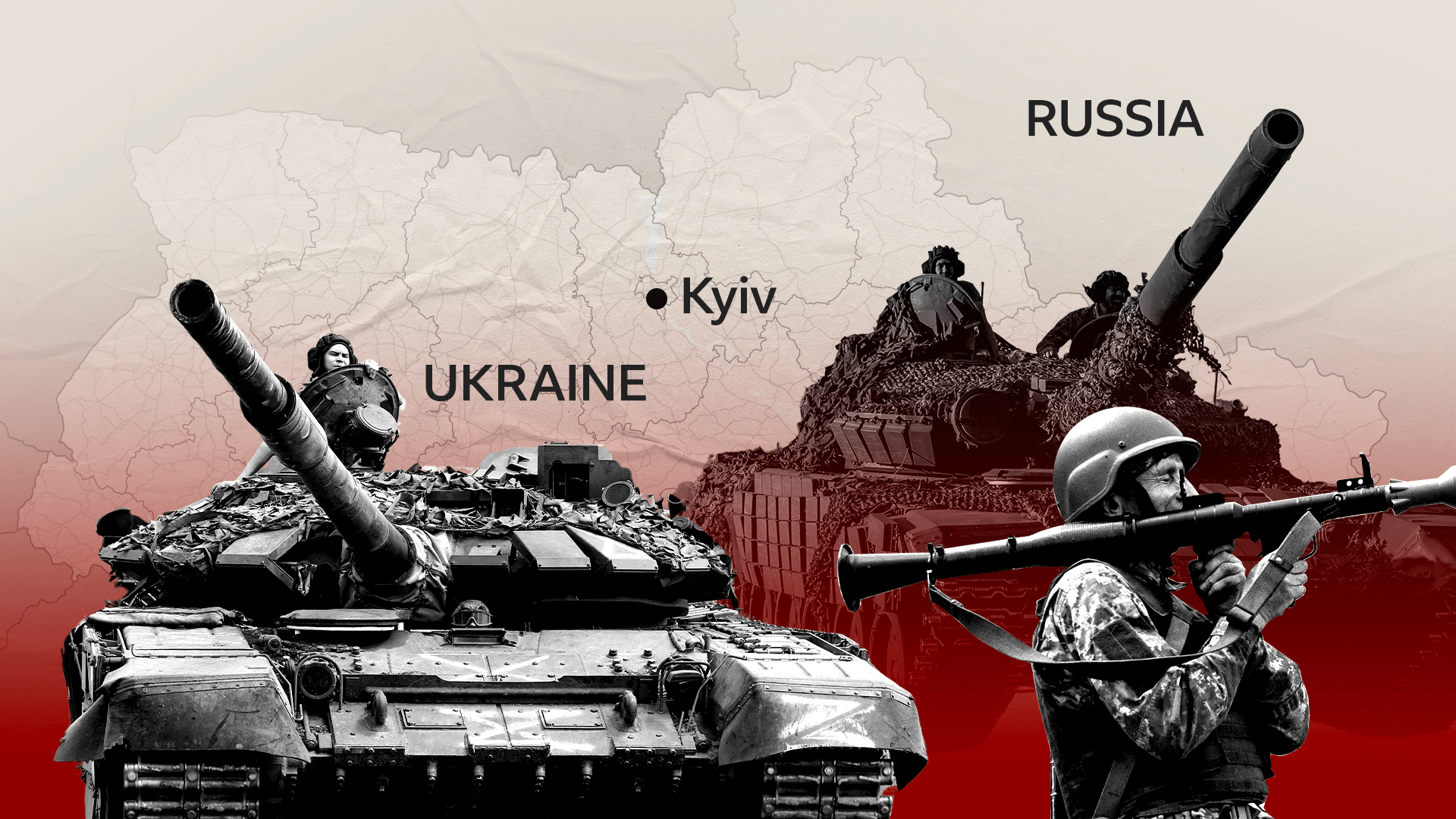

- Geopolitical Risks: Geopolitical tensions with Western countries can lead to sanctions and trade restrictions, impacting foreign investment.

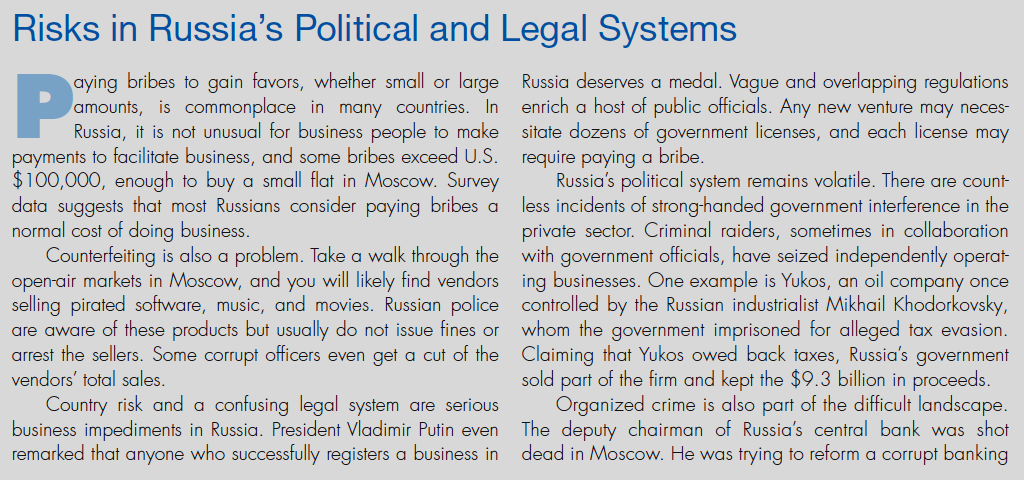

- Regulatory Uncertainty: The Russian regulatory environment can be complex and subject to frequent changes, creating uncertainty for investors.

- Corruption: Corruption remains a significant challenge in Russia, which can increase costs and risks for foreign investors.

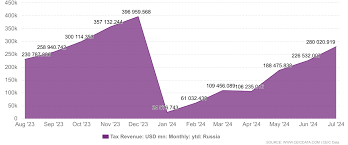

- Economic Volatility: Russia’s economy is susceptible to fluctuations in global commodity prices and geopolitical events.

- Currency Risk: Fluctuations in the Russian ruble can impact the value of investments.

Strategies for Successful Investment

To mitigate risks and maximize returns, investors should:

- Conduct Thorough Due Diligence: Carefully assess investment opportunities and potential risks.

- Partner with Local Entities: Partnering with local companies can help navigate the complex regulatory environment and mitigate risks.

- Diversify Investments: Diversifying investments across different sectors and regions can reduce risk.

- Hedge Against Currency Risk: Implement strategies to mitigate currency exchange rate fluctuations.

- Stay Informed: Keep abreast of political and economic developments in Russia.

While investing in Russia can be a rewarding endeavor, it requires careful consideration of the risks and challenges. By understanding the unique dynamics of the Russian market and implementing sound investment strategies, investors can capitalize on the opportunities and minimize the risks.

Leave a Reply